PRIMARY FUNCTIONS.

1) Accepting Deposits.

2) Granting Advances.

ACCEPTING DEPOSITS

The most important activity of a bank is to mobilize deposits from the public. People who have surplus income and savings find it convenient to deposit the amount with the bank.

TYPES OF DEPOSITS

1) Demand Deposits- Account holders can withdraw money any time and on demand.

2) Term Deposits- Deposits are repayable with interest only after the maturity period.

2) Term Deposits- Deposits are repayable with interest only after the maturity period.

TYPES OF DEMAND DEPOSITS.

1) Current Account.

2) Savings Account.

CURRENT ACCOUNT

- For business purposes.

- No interest is paid.

- No restriction on number of transactions.

- Overdraft(OD) facility available.

- OD- Customer is allowed to draw money over and above the balance in his/her account at the discretion of the Bank.

- Bank will charge interest on the amount overdrawn.

- Regular Savings Bank Account.

- Basic Savings Bank Deposit Account (BSBDA).

- To inculcate savings habit among citizens.

- Can be opened by individuals/jointly/non-profit organizations.

- Interest calculated based on daily basis on closing day balance.

- Interest compounded quarterly.

- Interest credited to the account half yearly.

- Minimum balance must be maintained(usually Rs500 without cheque book, Rs1000 with cheque book- may vary with bank).

- Penalty if minimum balance not maintained.

- Number of withdrawals from other bank ATM's are limited to 5.

Any individual including those from weaker sections of the society, can open zero balance account in any bank. BSBDA guidelines are applicable to all scheduled commercial banks in India, including foreign banks having branches in India.

- Any individual is eligible to have only one BSBDA in one bank.

- If the customer has any other existing savings account in that bank, he/she will be required to close it within 30 days from the date of opening BSBDA.

- Banks should offer ATM-cum debit card free of charge and no annual fee should be levied on such cards.

- Banks should provide free of charge, minimum 4 withdrawals through ATM's and other modes.

- Total credit should not exceed Rs 50,000 at any time.

- Maximum balance ion the account should not exceed Rs 50,000 at any time.

- Total debits by way of cash withdrawals and transfers should not exceed Rs 10,000 in a month.

TYPES OF TERM DEPOSITS.

1) Fixed Deposit.

2) Recurring Deposits.

FIXED DEPOSIT.

- The principle with interest is returned after a definite maturity.

- Interest rates are high.

- Minimum Duration- 7 days.

- Maximum Duration- 10 years.

- Minimum Amount- Rs 1000.

- The money is deposited in installments for a definite period of time. After the maturity period the deposited money with interest is returned back.

- Minimum installment- Rs100.

- Term- 1 to 10years.

GRANTING ADVANCES

The second primary function of commercial bank is to grant loans and advances. Such loans and advances are given to the members of the public and to the business community at a higher rate of interest than allowed by banks on various deposit accounts.

The difference between the rate rate of interest allowed on deposits and the rate charged on loans is the main source of bank's income called the Net Interest Income.

TYPES OF LOANS.

1. Demand Loans.

a) Gold Loan.

b) Crop Loan.

2. Term Loans.

a) Home Loan- Period- 15yrs, 20yrs, 25yrs, 30yrs.

b) Vehicle Loan- Period- 7yrs.

c) Personal Loan.

Secured Loan.

A loan with collateral is called a Secured Loan. i.e. the borrower pledges a property or other assets to the creditor and states that the creditor may take ownership of the property if the borrower defaults on the loan.

Eg: Mortgage Loan, Car Loan, Home Loan, Loan against property, Gold Loan, Crop Loan etc.

Unsecured Loan.

A loan that is not secured by ab asset or lien.

Eg: Personal Loan, Credit Card Loan, Bank Overdraft, Education Loan etc.

SECONDARY FUNCTIONS

1. Letter of Credit.

2. Bank Guarantee.

3. Travelers Cheque.

4. Vaults or Locker facility.

5. Foreign Exchange.

6. Fund Transfer.

7. Issuing Demand Draft and Pay Order.

LETTER OF CREDIT

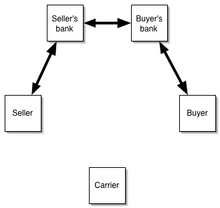

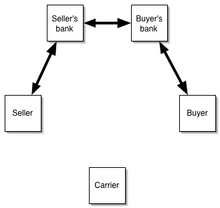

A Letter of Credit is a document issued by a financial institution, assuring payment to a seller of goods and services provided certain documents have been presented to the bank.

These are documents that prove that the seller has performed the duties under an underlying contract (eg. sale of goods contract) and the goods/services have been supplied as agreed. In return for these documents, the beneficiary(seller) receives payment from the financial institution that issued the letter of credit.

BANK GUARANTEE

Bank guarantee is a guarantee from a lending institution ensuring that the liabilities of a debtor will be met if the debtor fails to settle a debt.

For example, if an Indian Company wants to import machines from USA. The importer pledges a physical asset in the Bank and the Bank will issue a Bank Guarantee of certain amount subject to certain conditions which is given to the seller. In the event if the buyer does'nt pay the money the bank will take over the asset and make the payment.

TRAVELER'S CHEQUE

A Traveler's Cheque is issued by a financial institution that can be used as a medium of exchange in place of hard currency. Traveler's Cheque are often used by individuals who are traveling on vacation to foreign countries. Traveler's cheque provide a safe way to carry currency.

Traveler's Cheque is issued in variety of monetary denominations such as the US Dollar, Euro, Japanese Yen, Canadian Dollar, Australian Dollar and British Pound.

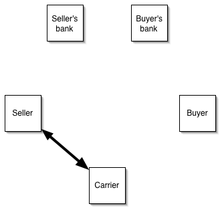

Seller provides bill of lading

to bank in exchange for payment. Seller's bank exchanges bill of lading

for payment from buyer's bank. Buyer's bank exchanges bill of lading

for payment from the buyer.

Buyer provides bill of lading to carrier and takes delivery of goods.

BANK GUARANTEE

Bank guarantee is a guarantee from a lending institution ensuring that the liabilities of a debtor will be met if the debtor fails to settle a debt.

For example, if an Indian Company wants to import machines from USA. The importer pledges a physical asset in the Bank and the Bank will issue a Bank Guarantee of certain amount subject to certain conditions which is given to the seller. In the event if the buyer does'nt pay the money the bank will take over the asset and make the payment.

TRAVELER'S CHEQUE

A Traveler's Cheque is issued by a financial institution that can be used as a medium of exchange in place of hard currency. Traveler's Cheque are often used by individuals who are traveling on vacation to foreign countries. Traveler's cheque provide a safe way to carry currency.

Traveler's Cheque is issued in variety of monetary denominations such as the US Dollar, Euro, Japanese Yen, Canadian Dollar, Australian Dollar and British Pound.

Thanks admin to share this useful and informative blog .Before reading this post i have no idea about Recurring Deposit and what is the difference and benefits of fixed deposit vs recurring deposit now i get a complete idea to started off my journey for best wealth creation.Keep on sharing.

ReplyDeleteRegards,

Arjun

Thanks for sharing details on the commercial banks. It is really informative. Get the Low Rate Personal Loans Online from the OurMoneyMarket.

ReplyDeleteI was dazzled by this post, this site has consistently been wonderful data about commercial banks. you especially for such a fascinating post, and I meet them all the more regularly then I visited this site. how much mortgage can I afford

ReplyDeleteI was very impressed by this post, this site has always been pleasant news. you very much for such an interesting post, and I meet them more often then I visited this site. car finance broker brisbane

ReplyDelete